Valuation Vs Value Creation: Unravelling the Startup Dilemma

By – Aryan Agarwal

INTRODUCTION

The Start-up ecosystem is a dynamic hub of ideas where priorities and metrics evolve and accordingly, the approach of the founders and the investors changes. Amidst such change, there is one thing which remains constant: the debate between Valuation and Value Creation. Before delving into this never-ending debate, we need to understand both the concepts and how they’re interrelated.

WHAT IS VALUATION?

Valuation, in simple terms, is the worth of a business organisation. Some people believe valuation to be hard science. This implies that it should be strictly based on the market value of assets held by a company and the revenue generated. However, some people disagree and argue that there is a lot more to the valuation of a company. This involves perceptions regarding the idea, ability to disrupt the market, competition, etc. However, these perceptions must be backed by reality. Accordingly, we have 3 different approaches used for the valuation of a company:

1. Asset Approach

2. Income Approach

3. Market Approach

Asset approach and income approach are more aligned with the principles of hard science, whereas market approach is inclined towards the idea of considering valuation as an art, thereby, giving more importance to the market conditions.

WHAT IS VALUE CREATION?

Unlike valuation, value creation is a concept which can be measured in objective quantitative terms. Value creation is the process of converting various inputs into a more valuable output via innovation and implementation. The objective of value creation is simple: it focuses on solving problems. Value creation can be measured by using metrics like Return on Capital Employed, Market Share, Customer Acquisition, etc.

VALUATION VS VALUE CREATION

Now that we have discussed and understood both the concepts, it is important to understand the relationship between both. The conventional notion always emphasised the significance of value creation for success in the long run. However, over the last few years, a new obsession with valuation has emerged in the market. People in the ecosystem fail to recognize the fact that value creation determines the valuation of a company and not the other way around. Hence, both concepts share a unidimensional relation. Following are some reasons why value creation must always be prioritized above valuation:

1. Valuation is Subjective

Valuation is something which can never be devoid of subjectivity. It requires human touch and is dependent on perception. It’s because of these reasons why we have stark differences in the valuation of the same company by different investors. This has often been the case with companies launching Initial Public Offerings with an unjustifiable valuation. For instance, consider Mamaearth. Despite becoming profitable recently during FY 22, the company eyes a whopping $3 billion valuation. The company tries to justify its valuation based on future projections. However, there is no way to verify these projections objectively. Similarly, Paytm launched its IPO at a valuation of $19 billion. In a span of one year, the stock has fallen by 70%, leading to large-scale wealth destruction. Such subjectivity has given rise to allegations which claim that the Paytm IPO valuation was pumped up so that the company could give a lucrative exit to its institutional investors.

2. Valuation is Temporary

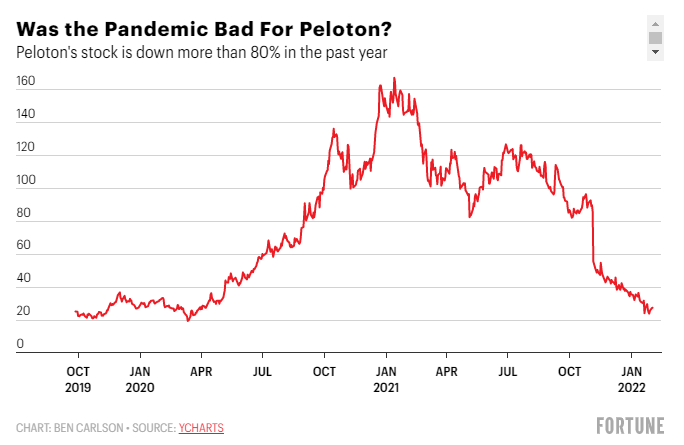

A major reason valuation can not be trusted is time relativity. A company having a peak valuation at one point can fall in a matter of a few days. This is something which has been specifically highlighted by the pandemic. For example, consider the curious case of Peloton. It’s a fitness company which specialises in stationary bicycles and treadmills which allow customers to work out in their homes itself.

Considering its product offerings, the company gained great traction during the pandemic when gyms and fitness centres were closed and inaccessible. By the end of 2020, the company had gained a market capitalization of $45 billion. Such a rise in capitalization compelled the company to scale without considering whether growth was sustainable or not. As a result, the company became a victim of the ‘bullwhip’ effect and took some premature decisions which led to the overloading of inventory and construction of empty warehouses. With time, the pandemic stabilized and the gyms reopened. This led to a predictable but sudden fall in the demand for products supplied by Peloton. The stock crashed and the market capitalization fell to a mere $2.63 billion. This displays how volatile and responsive valuation can be to market conditions.

3. Valuation Ruins the Business Environment

The obsession with valuation and growth often motivates companies to adopt a business model based on negative unit economics. Such a model can work only if a company has a structured plan for transition towards profitability. However, the current situation shows how companies with huge valuations don’t have a sustainable model to achieve profitability. Having negative unit economics is like selling dollar bills for 80 cents. It creates an illusory demand for products and services.

For example, consider the rise of Swiggy. One of the major reasons why Swiggy was able to scale in such a short span of time is the discounts and other promotional incentives offered to the consumers. It was never possible for small businesses to provide such discounts and simultaneously meet the cost of logistics. This motivated the consumers to switch platforms. To compensate for these incentives, Swiggy charges a commission on all the partnering restaurants and food providers. Now after years of operations and fundraising, the company is in a fix as it is far from achieving profitability. During FY 21, the company spent a total of INR 4139 Cr but only generated a revenue of INR 2547 Cr.

As the company continues to burn cash, it’ll have the only option of increasing commission and other charges to increase revenue without losing its customer base. This will harm restaurants which are already bleeding due to the pandemic. Therefore, this creates an ambiguous situation in the sector where the big players burn cash at the cost of the small businesses which are unable to survive.

CONCLUSION

It’s because of all these reasons why firms must realise that valuation is a passive event which in the long run can be only sustained by consistent value creation and not the other way around. Growth at the cost of profitability is bound to create problems which can’t be avoided. One can see the example of WeWork in order to understand how continuous burning of cash can hurt market sentiment.

On the contrary, value creation helps in building trust and credibility. This can be observed in the case of Zerodha which has developed a stellar reputation by generating profits of more than 2,000 Cr. INR with negligible outside investments. Thus, value creation places emphasis on feasible revenue models and consistent cash flows which ultimately supplement the valuation of the company. This creates a win-win situation for all the stakeholders involved.

CITATIONS

1. Sil, D. (2022, July 28). Swiggy Spent INR 4,139 Cr to Earn INR 2,547 Cr in FY21. Inc42 Media.

https://inc42.com/buzz/swiggy-spent-inr-4139-cr-to-earn-inr-2547-cr-in-fy21/

2. Karkera, S. (2021, May 23). Zomato and the Unit Economics Problem. Finshots.

https://finshots.in/archive/zomatos-unit-economics/

3. Corporate Professional Capital Pvt. Ltd. (n.d.). Valuation Services & Business Modelling – Corporate Professionals I SEBI Registered Merchant Banker.

http://www.corporatevaluations.in/research-article/obtain-valuation-for-your-company

4. Thomas, L. (2021, November 8). More than $10 billion wiped from Peloton’s market cap since dismal earnings report. CNBC.

https://www.cnbc.com/2021/11/08/more-than-10-billion-wiped-from-pelotons-market-cap-since-earnings.html

5. The True Measures of Success. (2014, August 1). Harvard Business Review.

https://hbr.org/2012/10/the-true-measures-of-success