Has Sustainable Financing Stopped Going Green Under Trump?

Prelude

‘Investing should be like watching grass grow,’ said Paul Samuelson. He probably meant it metaphorically, but what if I told you we should take it literally? Cue in the buzzword of the day: Sustainable Financing.

Simply put, it’s an umbrella term for all investment and financial transactions deliberately considering the environmental, social, and societal returns (besides the typical profit, of course).

What makes it interesting is that ESG (Environmental, Social, Governance) investments are not a typically niche ethical movement, but a true driver of change in the market system around the world because not only do they yield comparatively better returns, but there’s the added benefit of the ‘feel-good’ factor, asset stability and structural resilience.

In efforts to transition to a more environmentally sustainable world, banks, financial institutions and asset management companies have all joined in to refine their company policies, with ESG investments soon becoming the new norm, such as in India, where 75% of large Indian companies have defined sustainability goals, with 50% embedding ESG into their business strategies, as stated by IMA India. The number hovers over 86% for companies around the world.

ESG investing has evolved rapidly since the emergence and expansion of sustainable frameworks; it already accounts for over $592 billion in US assets and is (or rather, was?) expected to reach $33 trillion globally by 2026 as per a PwC report from 2022. In addition to reducing climate risk and generating social impact projects that address equity and inclusion, it has significantly increased finance flows into renewable energy. To encourage financial corporate change and innovation, major organisations are now incorporating ESG standards into their operations.

Much like Icarus, who soared through the sky with his wings of wax, only to fall to his death after flying too close to the sun, the second tenure of US President Donald Trump poses a bleak challenge for the future of green finance.

Will the new term only ‘fuel’ climatic and economic challenges, or is there hope for us after all?

Donald Trump, The Envirovillian

Trump’s policies have consistently opposed many core principles and government support for sustainable finance, especially centred around climate action, ESG investing, and support for green industries. It is no surprise that the US alone accounted for $7.7 trillion of climate-related damage, or 36% of its GDP growth last year.

Donald Trump’s administration oversaw one of the largest environmental policy reversals in U.S. history, rolling back over 100 regulations on air, water, wildlife, and toxic pollutants. According to sources cited by the Climate Action Campaign, it reduced USAID climate support by over $1.2 billion, terminated significant renewable energy subsidies, and phased down the $7,500 EV tax credit, all of which slowed adoption rates. Trump prioritized fossil fuel growth through budget cuts, regulatory delays, and weakened oversight during his first 100 days in office. He also withdrew from the Paris Agreement and stopped U.S. climate finance.

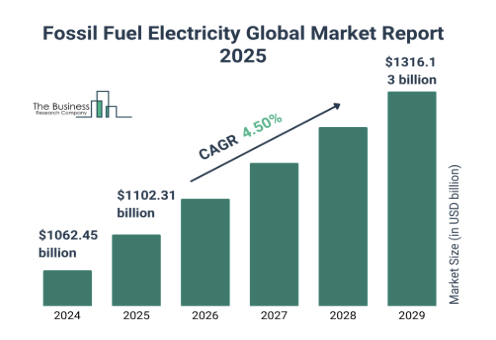

Infographic showing the increase in fossil fuel production since Trump’s re-election :

Source: The Business Research Company

Furthermore, now there are unmistakable signs that the US is exerting pressure on international regulatory organisations to set aside their climate policy. This has caused many large US Banks such as JPMorgan and Goldman Sachs to change tactics. Organisations aiming to curb emissions by 2030, such as NZBA, have also witnessed significant departures. It appears that Canadian banks have also turned their backs on their eco-pledges.

To limit the risks of asset management, several major US asset managers have also pushed back their ESG priorities. States such as Texas and Florida have restricted the use of ESG criteria in the management of public funds.

Following April, Treasury Secretary Scott Bessent further urged the IMF and the World Bank to scale down their climate action, with potential fear of a US exit from the agencies. It seems that the Trump administration doesn’t want to leave any stone unturned.

When America sneezes, the world catches a cold.

It would be unwise to underestimate the influence the US has on the world.

Think of the US housing crisis of ’08, cue in bank closures, corporate problems, and then the woes go global. Currently, the anti-ESG movement is firmly focused on the United States. There may be opposition from the EU and UK, but what happens when the anti-ESG backlash materialises amongst the public?

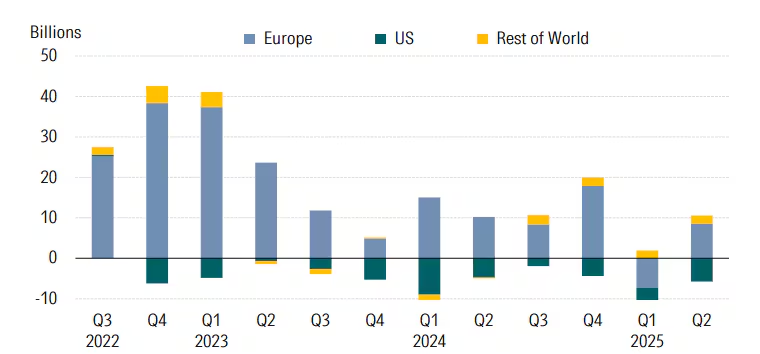

Exhibit A: Data by Morningstar elaborated on how investors withdrew $6.1 billion from ESG funds in the first three months of 2025, following the removal of $4.3 billion in Q4 2024.

Not to mention the amount of greenhushing that may begin. (Picture greenhushing as ‘radio silence’ – no firm says anything if they aren’t asked about their environmental approach, and if they are…they prefer to reroute the topic) Firms now have the option to resort to unsustainable financing, while still appealing to their stakeholders.

The US’s stance on climate issues is affecting the very ability of emerging markets to raise funds for their environmental projects. An attestment to this fact is that their sales of green bonds fell by a third in 2025 to $8 billion, the slowest since 2022, according to data compiled by Bloomberg.

Tariffs: Cash over Climate?

Trump’s tariff war has now evolved into a confrontation over ESG, putting sustainable finance at risk. Tariffs affect the wheres and hows of production, leading to ripple effects on carbon emissions, resource consumption, and labour conditions. Their effects are also seen in corporate finances, which subsequently influence the advancement of green investments.

The 2025 U.S. reciprocal tariffs have created multiple headaches for businesses in South and Southeast Asia. This does not bode well for many companies that might now have to face difficult choices between maintaining sustainable manufacturing practices and resorting to reactive cost-cutting to stay competitive. For instance, Vietnam, which heavily relies on exports, is confronting a drastic 46% tariff rate, leading to significant challenges in workplace conditions and an increase in job losses. Likewise, Cambodia’s textile sector, which is vital for its economy, faces serious threats as a result of these tariffs.

Let’s not forget India, which was recently hit with a 50% tariff rate, significantly impacting its ESG investments. Tariffs are known to increase inflation, causing the cost of clean tech imports from India, such as solar panels and other related green equipment, to be much higher. This situation is unfavourable for India, whose very role as a key exporter of green tech is threatened, causing a slowdown in the transition towards renewable energy in both India and the US. This dynamic makes achieving global climate goals more difficult.

Source: Wall Street Journal

The ripple effects of Trump’s tariffs pose a stark risk to the momentum of sustainable finance and global ESG goals. This raises an important question: how does one balance sustainability with profitability in such a scenario?

Hope for the planet

Trump has previously mischaracterised climate change as ‘woke capitalism’, going so far as to describe it as “a conspiracy orchestrated by China to undermine U.S. manufacturing.” His actions do create a cause for concern, but this is not the end of ESG investing. The decisions of a single economy cannot dictate the impact of sustainable finance globally.

Leading firms are accelerating diversification, not only to mitigate risk but also to embed ESG considerations by region. The Indian Economy, in particular, is not one to stand idle. Revisiting the international sanctions imposed by the US after the Pokhran Nuclear tests of 1998, which had caused a massive uproar with the depreciation in the domestic economy and the rupee reaching an all-time low, reminds us of when India strategically bounced back. It leveraged connections through corporations, wooed the international community, and immediately prompted a global outreach mission. The result? Seven years later, the same country (US) that had condemned India, blocking all credit lines into its economy, now recognised India’s de facto status and welcomed it in international civil nuclear energy commerce. Drawing a parallel, this alternative can create a way to manage risks from tariffs by broadening the investment and supply base, thus preserving and potentially enhancing ESG financing amid global trade uncertainties. India can choose to geographically diversify its production to countries belonging to BRICS to counterbalance the impacts of Trump’s policies.

Sustainability can also become India’s saviour. Boosting trade partnerships with the EU, Japan, and South Korea and investing in low-carbon industrial sectors can also become a great opportunity for Indian exporters to gain a competitive edge in climate-conscious markets.

In the field of green finance, it is also important to recognise the efforts of China, the rising superpower. Advancing green enterprises in the current landscape would be difficult without China’s support, as it dominates a large share of the global market for renewable energy and EV component manufacturing. Even if Western countries tighten restrictions on China, its influence in driving the clean energy industry cannot be overlooked.

Nowadays, sustainable policies in business environments have become the new norm, especially in the EU, where it is mandatory to follow ESG guidelines. The EU and UK have also opposed Trump’s environmental and ESG policies by doubling down on their own ambitious climate and sustainability agendas. This proves that there is still demand for green financing. European regulations, investor expectations, and supply chain pressures ensure that companies operating internationally cannot afford to blatantly neglect ESG considerations. Green investment is picking up speed and utilizing innovative resources. In 2024, it reached $2 trillion, nearly twice the amount invested in fossil fuels, further strengthening the green market.

Significant outflow of global sustainable funds in 2025 Q1, the EU is trying to bounce back in Q2.

Source: Morningstar Direct. Data as of June 2025.

Meanwhile, in the US, in the absence of federal support, the mantle of leadership must shift to states and cities. Businesses can become pivotal players in this area by partnering with local governments to drive eco-friendly initiatives, advocating for progressive policies, and ensuring these efforts align with the Sustainable Development Goals proposed by the UN. This decentralised approach can contribute to significant progress. Historically, activism from such firms can create an impact. Like, when Patagonia sued the U.S. government in 2017 over the reduction of Bears Ears National Monument. Now, they have successfully raised awareness and mobilised support for environmental protection.

Conclusion

As we reach the wake of Donald Trump’s second term, green finance is stagnating politically and facing multiple challenges. However, there is still a reason to be optimistic. Through the collective efforts of civil society, investors, and companies, we can still find alternatives to balance finance and corporate goals with sustainability. Urgency is the need of the hour, and we have pathways and instruments to achieve green finance. Perhaps our collective willpower can help us weather Trump’s storm.

Citations:

- Bloomberg News. (2025, August 11). How Trump tariffs on China would affect the clean tech sector. Bloomberg. https://www.bloomberg.com/news/articles/2025-08-11/how-trump-tariffs-on-china-would-affect-the-clean-tech-sector

- Carbon Brief. (2025). Experts: What does a Trump presidency mean for climate action? https://www.carbonbrief.org/experts-what-does-a-trump-presidency-mean-for-climate-action/

- Friends of the Earth. (2025). Donald Trump: Stupid things he’s said about the planet. https://friendsoftheearth.uk/climate-change/donald-trump-stupid-quotes

- Reccessary. (2025). Trump’s first 100 days: How U.S. climate rollbacks threaten the global green transition. https://reccessary.com/en/news/trump-first-100-days-2

- Rodrik, D. (2025, August). Trump’s tariffs: Where is the global resistance? Project Syndicate. https://www.project-syndicate.org/commentary/trump-tariffs-where-is-the-global-resistance-by-dani-rodrik-2025-08

- Soutar, R. (2025, January 16). What Trump’s second term means for sustainable finance. The Bureau of Investigative Journalism. https://www.thebureauinvestigates.com/stories/2025-01-16/what-trumps-second-term-means-for-sustainable-finance

- Takahashi, M. (2025). China’s clean energy policy: Why China will push for clean energy despite the Trump administration’s withdrawal from the Paris Agreement. Sasakawa Peace Foundation. https://www.spf.org/iina/en/articles/takahashi_05.html

- Tankov, P., & Zerbib, O. D. (2025). Will green finance weather the Trump storm? Polytechnique Insights. https://www.polytechnique-insights.com/en/columns/economy/will-green-finance-weather-the-trump-storm/

- AmbitiousPR. (2025). The state of ESG in the new age of Trump. LinkedIn. https://www.linkedin.com/pulse/state-esg-new-age-trump-ambitiouspr-18ebe/

- Trebilco, J. (2025). Trumping Trump’s imperative: Why U.S. companies must lead on ESG. LinkedIn. https://www.linkedin.com/pulse/trumping-trumps-imperative-us-companies-lead-james-trebilco–ajjef/

- Eshe Nelson. (2025). Trump climate action banks. The New York Times. https://www.nytimes.com/2025/01/20/business/trump-climate-action-banks.html

- Collin Eaton. (2025). Trump goes to bat for big oil on climate rules in EU trade talks. The Wall Street Journal. https://www.wsj.com/business/energy-oil/trump-goes-to-bat-for-big-oil-on-climate-rules-in-eu-trade-talks-e38b35ec

- Michael Toth. (2025). Donald Trump, environmentalist? The Wall Street Journal (Opinion). https://www.wsj.com/opinion/donald-trump-environmentalist-biden-misguided-climate-policy-hurt-fragile-ecosystems-animals-c9321c74

- Wall Street Journal. (2025). How has investing in DEI and ESG changed under Trump? The Wall Street Journal (Podcast). https://www.wsj.com/podcasts/take-on-the-week/how-has-investing-in-dei-and-esg-changed-under-trump/dff5f665-a57d-4546-a625-34bccc6f20b3

- Adam Yee. (2025). Tariffs vs. sustainability: The impact of Trump’s 2025 tariff policy on ESG in APAC. Argon & Co. https://www.argonandco.com/en/news-insights/articles/tariffs-vs-sustainability-the-impact-of-trumps-2025-tariff-policy-on-esg-in-apac/

- Shaswata Kundu Chaudhuri. (2025). US tariffs present India opportunities to develop relations with climate-aligned nations. Carbon Copy. https://carboncopy.info/us-tariffs-presents-india-opportunities-to-develop-relations-with-climate-aligned-nations/

- Rituraj Baruah. (2025). India needs $1.5 trillion to meet 2030 climate and energy goals: Deloitte. Mint. https://www.livemint.com/news/india-needs-1-5-trillion-to-meet-2030-climate-and-energy-goals-deloitte-11752761356895.html

- AXA Investment Managers. (2025). Sustainability in the age of Trump: Why investors should focus on reality, not rhetoric. AXA Investment Managers. https://www.axa-im.com/investment-institute/asset-class/sustainability-age-trump-why-investors-should-focus-reality-not-rhetoric

- Pablo Grandjean, Axelle Van Wynsberghe. (2025). Europe cannot sacrifice financial regulation to Trump’s economic warfare. Finance Watch. https://www.finance-watch.org/blog/europe-cannot-sacrifice-financial-regulation-to-trumps-economic-warfare/

- Philippa Nuttall. (November 13, 2024). Will the EU use Trump’s victory to go for gold on climate—or as an opportunity to go slow? CleanTech for Europe. https://www.cleantechforeurope.com/news/will-the-eu-use-trumps-victory-to-go-for-gold-on-climate-or-as-an-opportunity-to-go-slow

- Philippa Nuttall. (2025). Will the EU use Trump’s victory to go for gold on climate—or as an opportunity to go slow? Sustainable Views. https://www.sustainableviews.com/will-the-eu-use-trumps-victory-to-go-for-gold-on-climate-or-as-an-opportunity-to-go-slow-3e70f719/

- Finance Watch. (2025). Europe cannot sacrifice financial regulation to Trump’s economic warfare. https://www.finance-watch.org/blog/europe-cannot-sacrifice-financial-regulation-to-trumps-economic-warfare/